Who is a CS Executive?

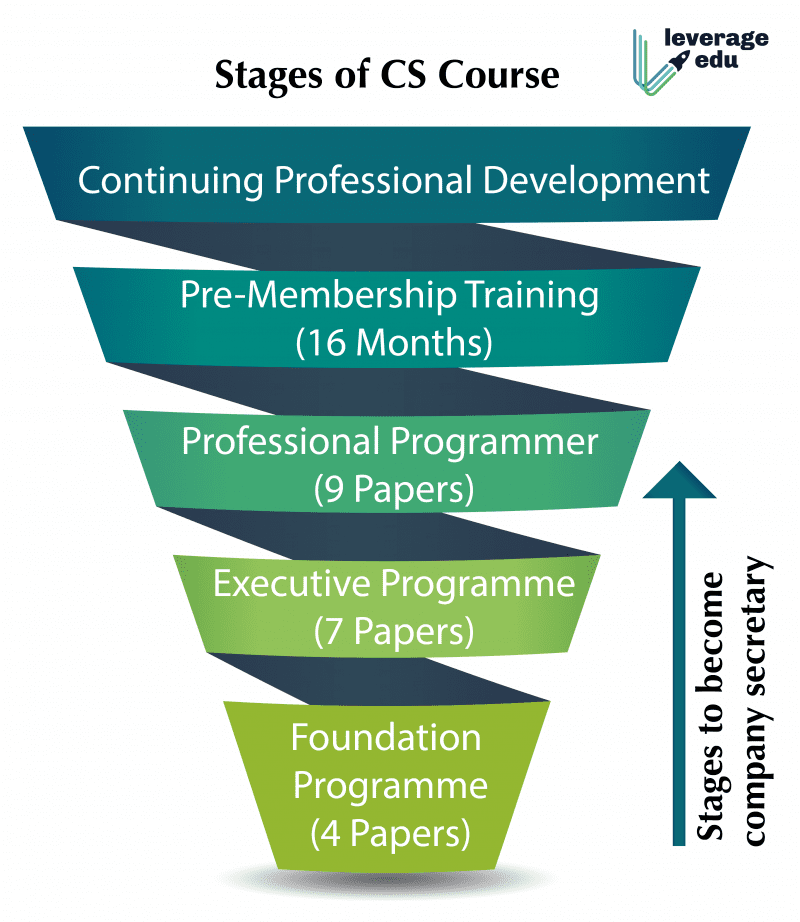

The ICSI or Institute of Company Secretaries in India is responsible to evaluate and training professionals interested in this work profile. It is a statutory body. The CS programme in India can be bifurcated into 3 major parts. One of them is CS Executive which is 9 months long in duration. Applicants completing this course stand a chance to work in corporate governance, secretariat boards and foreign collaborations. Given below is the breakdown of the entire CS course:

| Level | Duration |

| CS Foundation | 3 Months |

| CS Executive | 9 Months |

| CS Professional | 10 Months |

CS Executive June 2023 & December 2023 Syllabus

The new CS Executive syllabus was introduced by the authorities for June 2023 exam. Here is the CS Executive syllabus for June 2023 and December 2023:

Module I

| Old Syllabus | New Syllabus | Marks |

| Tax Laws & Practice | Tax Laws | 100 |

| Company Law | Jurisprudence, Interpretation & General Laws | 100 |

| Cost & Management Accounting | Company Law | 100 |

| Economic & Commercial Laws | Setting up of Business Entities and Closure | 100 |

Module II

| Old Syllabus | New Syllabus | Marks |

| Company Accountants and Auditing Practices | Corporate & Management Accounting | 100 |

| Industrial, Labor and General Laws | Economic, Business and Commercial Laws | 100 |

| Financial and Strategic Management | Financial and Strategic Management | 100 |

| Capital Markets and Securities Laws | Securities Laws & Capital Markets | 100 |

Certainly, here is a rewritten description of the CS Executive Module 1 subjects:

Module 1 Subjects for CS Executive

The CS Executive syllabus consists of eight subjects organized into two modules. Module 1 of CS Executive focuses on fundamental aspects of company and business laws, taxation, and the legal framework. Below is an overview of the subjects in CS Executive Module 1:

- Jurisprudence, Interpretation, and General Laws (Paper-1):

This subject is pivotal for aspiring Company Secretaries. It encompasses a wide range of legal aspects, including the Constitution of India, various Acts, Laws of Torts, Interpretation of Statutes, and general rules. Topics covered include specific relief, evidence, stamp duties, registration, general clauses, arbitration, Right to Information (RTI), and more. - Company Laws (Paper-2):

Company Laws are at the core of a Company Secretary’s responsibilities. This subject delves into the legal framework governing businesses. It is divided into three sub-modules:

- Company Laws, Principles, and Concepts

- Company Administration and Meetings, Law, and Practices (covering Board and General Meetings, Key Managerial Personnel, Directors, and Secretarial Standards)

- Company Secretary as a Profession

- Setting up of Business Entities and Closure (Paper-3):

This subject assesses your knowledge and skills related to establishing and managing various business entities, as well as handling business closures. It consists of three parts:

- Part 1: Setting up of Business (covering various types of business entities, professional firms, and business setup outside India)

- Part 2: Registration, License, and Compliances

- Part 3: Liquidation, Insolvency, and Closure of Business

- Tax Laws (Paper-4):

A crucial aspect of a Company Secretary’s role involves managing taxation matters. The Tax Laws subject evaluates your ability to calculate and handle tax-related issues. It is divided into two parts:

- Direct Taxes

- Indirect Taxes

These CS Executive Module 1 subjects equip students with the necessary legal and financial knowledge to excel in the field of corporate governance and company secretarial practice.

Certainly, here is a rewritten description of the CS Executive Module 2 subjects:

Module 2 Subjects for CS Executive

Module 2 of CS Executive delves deeper into the realms of corporate finance, accounting, legal compliance, and strategic management. These subjects are essential for Company Secretaries seeking to excel in their roles. Here’s an overview of the CS Executive Module 2 subjects:

- Corporate and Management Accounting (Paper-5):

Corporate and Management Accounting focuses on creating effective accounting systems for organizations to manage financial transactions, investments, and loans. This subject within CS Executive Module 2 comprises four parts:

- Corporate Accounting

- Accounting Standards

- Concepts and Principles of Valuation

- Cost and Management Accounting

- Securities Laws and Capital Market (Paper-6):

This subject explores the legal aspects of the financial industry and the government regulations applicable to both public and private sector companies. It is divided into two parts:

- Securities Laws

- Capital Markets and Intermediaries (covering equities, different voting rights, corporate debts, and Indian depository refunds)

- Economic, Business, and Commercial Laws (Paper-7):

Adhering to commercial and business laws is paramount for a Company Secretary. In this subject, students gain knowledge of various Economic, Business, and Commercial Laws, ensuring their organizations stay compliant. It is divided into three parts:

- Foreign Exchange Management and NBFCs

- Competition Laws

- Business and Commercial Laws

- Strategic and Financial Management (Paper-8):

Managing a company’s finances and strategically allocating funds and resources is a key responsibility of a Company Secretary. This subject in the CS Executive syllabus assesses a candidate’s understanding of strategic and financial management within an organization. It consists of three parts:

- Strategic Management (covering an overview of financial management, leadership, and components of business)

- Financial Management (addressing objectives, risk-return, value of the firm, and more)

- Information Technology

These CS Executive Module 2 subjects equip students with the necessary skills and knowledge to excel in corporate finance, legal compliance, and strategic management, making them well-prepared for their roles as Company Secretaries.