Welcome to “The Ultimate Guide to the CA Course 2023. If you’re an aspiring Chartered Accountant (CA) or someone intrigued by the world of finance and accounting, you’ve come to the right place.

Embarking on the journey to become a CA is a rewarding yet challenging path that opens doors to exciting career opportunities in the fields of accounting, finance, taxation, auditing, and consultancy. As a CA student, you’ll delve deep into the realm of financial expertise, honing your skills and knowledge to navigate the complexities of the business world.

1.1 About the CA Course

The CA course is designed to provide in-depth knowledge and practical skills in accounting, auditing, tax, financial management and other related fields. The goal is to produce highly competent and ethical accounting professionals.

1.2 Why Become a Chartered Accountant (CA)?

- Versatility and global recognition

- High demand

- Excellent career prospects

- Job stability

- Challenging and dynamic work

- Specialization opportunity

- High earning potential

- Continuous learning and development

- Ethical standards

- Contribution to society

1.3 Who Should Pursue the CA Course?

The Chartered Accountancy (CA) course is a professional qualification that prepares people to become chartered accountants. It requires dedication, commitment and certain skills. Here are some things for those who want to take a CA course to keep in mind:

- Accounting candidates

- Strong analytical skills

- Good communication skills

- Willingness to learn

- Problem solving

- Ethical behavior

- High level of discipline

- Long term career goals

- Entrepreneurial aspirations

- International opportunities

- Job stability and prestige

1.4 Prerequisites for Enrolling in the CA Course

- The candidate must pass a 10+2 (intermediate) exam or equivalent from a recognized body, or

- The candidate must pass bachelor’s degree in (Commerce ,arts or science)

2. Getting Started with the CA Course

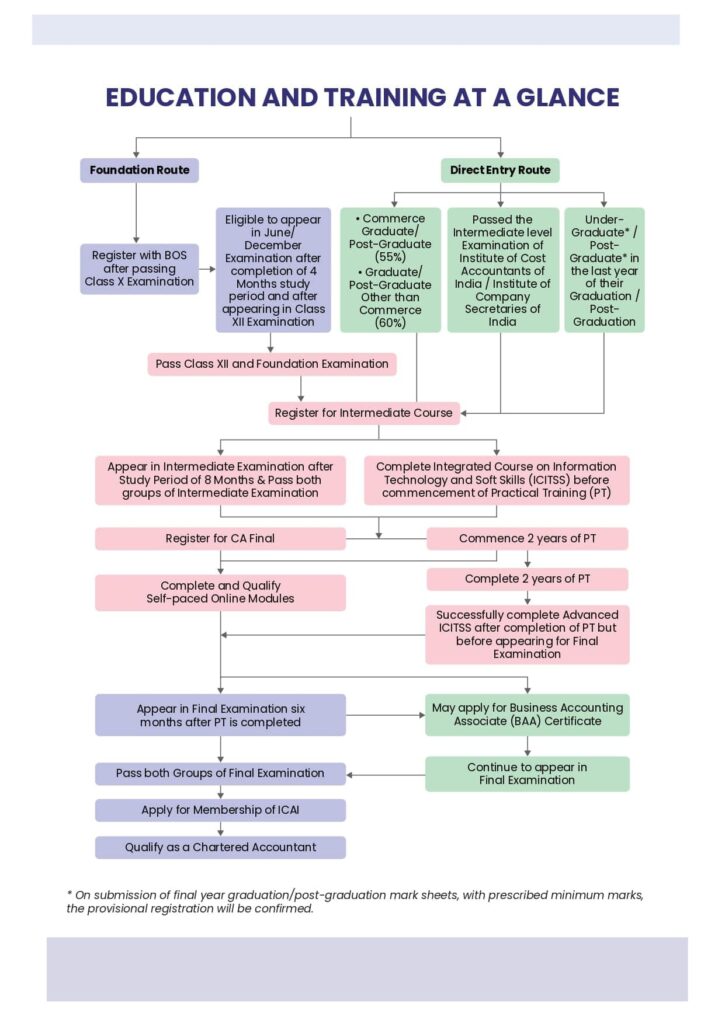

2.1 Route I: Foundation Course

This is an entry to the CA Course for the candidates who have appeared for class XII examinations.

Under this route, a Class X passed student may register himself with the Board of Studies (BoS) of the Institute

for the Foundation Course.

Steps under foundation route scheme are as under:

- Register and complete 4 months of theoretical education for the Foundation Course.

- Apply for appearing in Foundation examination by filling up the prescribed Exam Form released by

the Examination Section/Department. - Appear in Foundation Examination after appearing in Class XII Examination.

- Qualify Foundation Examination.

- Register for Intermediate Course after qualifying Class XII Examination and Foundation

Examination. - Complete 8 months of theoretical education for the Intermediate Course.

- Apply for appearing in Intermediate examination by filling up the prescribed Exam Form.

- Appear and Pass both the Groups of Intermediate Examination.

- Complete Integrated Course on Information Technology and Soft Skills (ICITSS) before

commencement of Practical Training. - Register for two year Practical Training after passing both the Groups of Intermediate Examination

and completing ICITSS. - Register for the Final Course after qualifying both Groups of Intermediate Examination.

- Complete the four Self-paced Online Modules and qualify the online assessment.

- Complete Practical Training.

- Undergo and Qualify Advanced ICITSS after completion of Practical Training but before appearing

in the Final Examination. - Apply for appearing in Final examination by filling up the prescribed Exam Form.

- Appear in Final Examination after completing six months from the end of the Practical Training

period. - Qualify both groups of Final Examination.

- Become a Member.

2.2 Route II: Direct Entry

Eligibility: Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/ Post-Graduates (with minimum 60% marks) and Intermediate level passed candidates of Institute of Company Secretaries of India and Institute of Cost Accountants of India.

Steps under Direct entry scheme are as under:

- Register with the BoS for the Intermediate Course (provisional registration allowed to the Final year

graduates/post graduates).* - Complete 8 months of theoretical education of the Intermediate Course.**

- Apply for appearing in Intermediate examination by filling up the prescribed Exam Form.

- Appear and Pass both the Groups of Intermediate Examination.

- Complete Integrated Course on Information Technology and Soft Skills (ICITSS) before

commencement of the Practical Training. - Register for two year Practical Training after passing both the Groups of Intermediate Examination

and completing ICITSS. - Register for the Final Course after qualifying both Groups of Intermediate Examination.

- Complete the four Self-paced online modules and qualify the online assessment.

- Complete Practical Training.

- Undergo and qualify Advanced ICITSS on completion of Practical Training but before appearing in the

Final Examination. - Apply for appearing in Final examination by filling up the prescribed Exam Form.

- Appear in Final Examination after completing six months from the end of the Practical Training period.

- Qualify both groups of Final Examination.

- Become a Member.

*On submission of final year graduation/post-graduation mark sheets, the registration will be confirmed

** Provisionally registered students can complete the 8 months study period during last year of graduation/ post-

graduation. They should have, however, passed graduation/ post-graduation, as the case may be, with prescribed minimum marks, at the time of filling up the exam form for Intermediate Examination.

2.2 Registration Process and Requirements

To begin your Chartered Accountancy (CA) course registration in India, follow these steps:

1. Visit the ICAI Website: Start by accessing the official website of the Institute of Chartered Accountants of India (ICAI) through https://www.icai.org/

2. Navigate to the “Students” Section: Once on the homepage, locate and click on the “Students” tab.

3. Access Course Registration Forms: Within the “Students” section, find and click on the “Course Registration Forms” option. Choose the appropriate level for your registration, which could be Foundation, Intermediate, or Final.

4. Complete the Registration Form: Fill out the registration form accurately with all required details, including your full name, date of birth, address, educational background, and any other necessary information.

5.Upload Essential Documents: Scan and upload necessary documents, such as your photograph, signature, academic transcripts, and any other relevant records.

6.Make the Registration Payment: Pay the registration fee using secure online options like net banking, debit card, or credit card.

7. Submit Your Registration: Once you’ve filled in the form and completed the payment, submit your registration form through the online portal.

8. Obtain Acknowledgement: After submitting the registration, generate an acknowledgement receipt online. It’s essential to keep a record of this acknowledgement.

9. Admit Card: you may download CA Exam Admit card as per Notification issued by ICAI>

Remember, the specific steps in the registration process might vary based on the Institute of Chartered Accountants of India’s current policies and regulations. It’s recommended to verify the latest registration guidelines on the official ICAI website before initiating your CA course registration.

2.3 CA Course Duration

The duration of the CA course can vary based on individual performance. On average, the duration for each level is as follows:

Foundation Course: 4 months (minimum study period)

Intermediate Course: 8 months (minimum study period)

Final Course: 2 years (including articleship training)

Please note that these are the minimum study periods, and students may take longer to complete the course based on their performance in the examinations.

2.4 CA Course Study Plan

A well-structured study plan is crucial to excel in the CA course. Here’s a general study plan you can follow for each level:

Foundation Course:

- Focus on understanding the fundamentals of accounting, economics, law, and mathematics.

- Practice regularly and solve previous years’ question papers.

- Take mock tests to assess your preparation.

Intermediate Course:

- Learn about advanced accounting, auditing, tax, and corporate regulations.

- Strengthen your conceptual knowledge.

- Solve different problems to improve your problem solving skills.

- Run sample tests and evaluate the results.

Final Course:

- Focus on the in-depth study of advanced financial reporting, strategic financial management, advanced auditing and professional ethics.

- Keep up to date with the latest tax and corporate news.

- Solve case studies and practical problems to improve your analytical skills.

- Come for practice tests and retake tests to improve your exam preparation.

2.5 CA Course Fees Structure

The Institute of Chartered Accountants of India (ICAI) determines the fee structure for the Chartered Accountancy (CA) course in India, subject to potential fluctuations over time. The approximate fees for each CA course level are as follows:

Foundation Course: The approximate fee for the Foundation course is roughly Rs. 9,800/-.

Intermediate Course: The estimated fee for the Intermediate course is approximately Rs. 18,000/-.

Final Course: The rough fee for the Final course is around Rs. 22,000/-.

In addition to the aforementioned course fees, students are obligated to cover registration fees, examination fees, and other applicable charges. The expenses related to study materials, coaching, and supplementary resources can differ based on individual choices and geographical location.

It’s important to emphasize that the mentioned fees are approximate and subject to change due to various factors, including ICAI’s policies, the location of coaching centers, and miscellaneous expenses.

3. CA Foundation Course

3.1 Introduction to the CA Foundation Course

The CA Foundation is an entrance exam for the Chartered Accountancy (CA) course offered by the Institute of Chartered Accountants of India (ICAI). It replaced the previous Common Proficiency Test (CPT) and was intended to adapt the program to the latest developments in the financial sector. The CA Foundation is designed to provide students with a solid foundation in accounting, economics, business law, and quantitative skills.

3.2 Eligibility Criterial for applying CA Foundaiton Course

Before enrolling in the CA Foundation course, you need to meet certain eligibility requirements:

Educational Qualification: You must have completed 10+2 or its equivalent from a recognized educational board.

Registration: You need to register with the ICAI for the CA Foundation course. Registration typically remains open throughout the year, and you can apply online on the official ICAI website.

3.2 Subjects and Syllabus

The CA Foundation course comprises four subjects, :

Paper 1: Accounting – 100 marks

Paper 2: Business Laws – 100 marks

Paper 3: Quantitative Aptitude – 100 marks

- Mathematics

- Statistics

- Logical Reasoning

Paper 4: Business Economics – 100 marks

3.3 Study Tips and Preparation Strategies

Preparing for the CA Foundation exam requires dedication, discipline, and a well-structured study plan. Here are some tips to help you succeed:

Understand the Syllabus: Familiarize yourself with the syllabus and exam pattern to create a comprehensive study plan.

Quality Study Material: Refer to the official study material provided by the ICAI and supplement it with quality Study modules provided by Agarwal Coaching Centre for getting good marks in Examinations.

Time Management: Allocate sufficient time for each subject and prioritize your weaker areas.

Practice: Regularly solve sample papers and attempt mock tests to improve your speed and accuracy.

Seek Guidance: Join a reputable coaching institute or seek guidance from experienced mentors to clarify doubts and gain valuable insights.

3.4 CA Foundation Exam Pattern and Grading

The CA Foundation examination is held twice a year, in May and November. The test consists of objective-type questions for 100 marks per paper, with negative marking for incorrect answers.

3.5 Passing Criteria and Results

To pass the exam, you need to secure a minimum of 40% in each paper and an aggregate of 50% across all papers in a single attempt.

CA Foundation Study Material

At Agarwal Coaching , we provide comprehensive study Material for CA Foundation. Students can also visit official website for CA Foundation Study Material.

FAQ on CA Foundation

When can I register for Foundation Course?

Ans: Candidates may register in Foundation Course after passing Class 10th Examination

conducted by an examining body constituted by law in India or an examination recognized

by the Central Government or the State Government as equivalent thereto.

What is the fee for Foundation Course?

Ans:Fee for Foundation Course is Rs.9,000/- which is to be paid at the time of registration.

This fee is inclusive of Prospectus for CA Course and Study Material of Foundation Course.

Where can I get the Prospectus for CA Course and Study Material of Foundation Course?

Ans:After successful registration in the Foundation Course, the student will receive an e-mail

bearing the login credentials for ordering the Study Material through Centralized Distribution

System (CDS) Portal. Prospectus for CA Course will be delivered to the student along with the

Study Material, whenever ordered by the student

Can I get refund of Registration fees of CA Foundation?

When will I get the Study Material of Foundation Course?

Ans: Study Material of Foundation Course will be available on the BoS Knowledge Portal at the

link https://www.icai.org/post/new-scheme-of-education-and-training after the launch of the

New Scheme of Education and Training on 1st July, 2023. Hard copy of the Study Material

will be available for ordering on Centralized Distribution System (CDS) Portal upon

confirmation of registration in Foundation Course

How to change CA Foundation Exam centre?

How to change medium of exam after CA Foundation Registration?

Where do I get best face to face classes for CA Foundation?

I have already registered in Foundation Course after passing Class 10th Examination and presently I am in Class 11. When I will be eligible for Foundation Examination and under which Scheme of Education and Training.

Ans: Your first attempt for Foundation Examination under New Scheme of Education and

Training will be in June, 2025 after appearing in Class 12th examination conducted by an

examining body constituted by law in India or an examination recognized by the Central

Government or the State Government as equivalent thereto.

I have already registered in Foundation Course and presently I am in Class 12. When I will be eligible for Foundation Examination and under which Scheme of Education and Training

Ans: Your first attempt for Foundation Examination under New Scheme of Education and

Training will be in June, 2024 after appearing in Class 12th examination conducted by an

examining body constituted by law in India or an examination recognized by the Central

Government or the State Government as equivalent thereto

When I can register in Foundation Course to become eligible for June/ December Foundation Examination.

Ans: You should be registered in Foundation Course with the Board of Studies of the Institute

for a minimum period of four months on or before the 1st day of the month in which the

examination is held. For example, you should be registered in Foundation Course on or

before 1st February, 2024 for June, 2024 Foundation Examination and on or before 1st

August, 2024 for December, 2024 Foundation Examination. Before appearing in the

Foundation Examination, you should also have appeared in Class 12th Examination

conducted by an examining body constituted by law in India or an examination

recognized by the Central Government or the State Government as equivalent thereto.

Do I need to fill any separate form for appearing in Foundation Examination?

Ans: After registration in Foundation Course, you need to submit the online examination form

for appearing in Foundation Examination. The examination form for June and December

examination usually opens in the month of February and August respectively.

ICAI makes an announcement when the examination forms open for the forthcoming

examination. You are advised to visit the Institute’s website for announcements.

What will be the syllabus for Foundation June, 2024 Examination?

Ans: Foundation June, 2024 Examination will have the syllabus of the New Scheme of Education

and Training, which is available at the link

https://www.icai.org/post/new-scheme-of-education-and-training

When are Foundation Examinations held?

Ans: Foundation Examinations are held twice a year in the months of June and December.

What is the examination pattern in Foundation Examination?

Ans: Paper 1 & 2 are subjective type and Paper 3 & 4 are objective type.

Can I change the medium of CA Foundation exams after Registration

Is there negative marking in Foundation Examination?

Ans: Yes, there is negative marking of 0.25 mark for every wrong answer in objective type

papers.

What is the passing criteria for Foundation Examination?

Ans: A student is declared to have passed the Foundation examination, if he/she obtains at

one sitting a minimum of 40% marks in each paper and a minimum of 50% marks in the

aggregate of all the papers.

What is the validity period of student's registration in the Foundation Course?

Ans: The validity period for registration in the Foundation Course is for 4 years from the first

eligible attempt in the Foundation Examination.

What is the validity period of student's registration in the Foundation Course?

Ans: The validity period for registration in the Foundation Course is for 4 years from the first

eligible attempt in the Foundation Examination.

Whether revalidation of registration is permitted at the Foundation level?

Ans: Revalidation is not permitted at the Foundation level.

4. CA Intermediate Course

4.1 Overview of the CA Intermediate Course

The CA Intermediate is the second level of the Chartered Accountancy (CA) course conducted by the Institute of Chartered Accountants of India (ICAI). This stage builds upon the foundation laid during the CA Foundation course, providing more comprehensive knowledge and practical skills in various aspects of accounting and finance.

4.2 Eligibility Criterial for Applying for CA Intermediate course

Before enrolling in the CA Intermediate course, you need to fulfill the following eligibility requirements:

Qualification: You must have passed the CA Foundation exam or the Common Proficiency Test (CPT).

Registration: You need to register with the ICAI for the CA Intermediate course. Registration is generally open throughout the year, and you can apply online on the official ICAI website.

4.3 Subjects and Syllabus

The CA Intermediate course is divided into two groups, with four papers in each group:

Group I:

- Paper 1: Advanced Accounting (100 marks)

- Paper 2: Corporate and Other Laws (100 marks)

- Paper 3: Taxation

Section A – Income-tax Law (50 Marks

Section B – Indirect Taxes (50 Marks)

Group II:

- Paper 4: Cost and Management Accounting (100 marks)

- Paper 5: Auditing and Ethics (100 marks)

- Paper 6: Financial Management and Economics for Finance Strategic Management (100 marks)

4.4 Exam Format and Evaluation

The CA Intermediate examination is conducted twice a year, in May and November. The test consists of subjective and objective-type questions, with the objective papers also having negative marking for incorrect answers. To pass the exam, you need to secure a minimum of 40% in each paper and an aggregate of 50% across all papers in a single attempt.

4.5 Preparing for the CA Intermediate Exam

Preparing for the CA Intermediate exam requires diligence, dedication, and a strategic approach. Here are some tips to help you excel:

Thoroughly Understand the Syllabus: Comprehend the entire syllabus and create a well-organized study plan.

Study Material and Practice: Utilize the official study material provided by ICAI and supplement it with reference books and practice manuals. Practice solving previous years’ question papers and mock tests.

Time Management: Allocate sufficient time for each subject and prioritize topics based on their weightage.

Coaching and Guidance: Enroll in a reputed coaching institute to receive expert guidance and clarify your doubts.

Stay Consistent: Consistency in studying and revising regularly is key to success.

FAQ on CA Intermediate

How can I register for Intermediate Course?

Ans: A candidate can register in Intermediate Course through either of the following two routes:

(i) Foundation Route

(ii) Direct Entry Route

What is the eligibility criteria for registering in Intermediate Course through Foundation Route?

Ans: Candidates after passing Foundation Examination and Class 12th examination conducted

by an examining body constituted by law in India or an examination recognized by the

Central Government or the State Government as equivalent thereto, are eligible for registration

to Intermediate Course through Foundation Route.

What is the eligibility criteria for registering in Intermediate Course through Direct Entry Route?

Ans: Graduates/ Post-Graduates in Commerce (with minimum 55% marks) or Graduates/

Post-Graduates other than in Commerce (with minimum 60% marks) or Intermediate level

passed candidates of Institute of Company Secretaries of India/ Institute of Cost Accountants

of India are eligible for registration to Intermediate Course through Direct Entry Route.

I am pursuing the last year of Graduation. How can I join CA Course?

Ans: You can register provisionally for the CA Intermediate Course through Direct Entry Route.

After completing the Graduation with requisite marks and completion of eight months of study

period in Intermediate Course from the date of provisional registration, you would become

eligible to appear in Intermediate Examination.

I have registered provisionally for Intermediate Course through Direct Entry Route and my Graduation result is awaited. When will I become eligible for Intermediate Examination?

Ans: You will become eligible for Intermediate Examination after completing the Graduation

Course with requisite marks and completion of eight months of study period in Intermediate

Course from the date of provisional registration.

I have secured requisite marks in Graduation and I am pursuing Post-Graduation. How can I join CA Course?

Ans: You can register for the Intermediate Course through Direct Entry Route based on the

marks secured in Graduation and appear in the Intermediate Examination after completion

of eight months of study period from the date of registration.

I have not secured requisite marks in Graduation and I am pursuing Post-Graduation. How can I join CA Course?

Ans: You can register provisionally for the Intermediate Course through Direct Entry Route

during the last year of Post-Graduation. After completing the Post-Graduation with requisite

marks and completion of eight months of study period in Intermediate Course from the date

of provisional registration, you would become eligible to appear in Intermediate Examination.

I have registered provisionally for Intermediate Course through Direct Entry Route. When will my registration get confirmed?

Ans: If you have registered in the last year of Graduation, your Intermediate Course provisional

registration will be confirmed after submission of marksheet of Graduation examination result

with requisite marks. The marksheet should be submitted within six months of declaration of

result of Graduation examination.

Alternatively, if you have registered in the last year of Post-Graduation, your provisional

registration will be confirmed after submission of marksheet of Post-Graduation examination

result with requisite marks. The marksheet should be submitted within six months of

declaration of result of Post-Graduation examination.

When are the Intermediate Examinations held and what is the cut-off date for registration in Intermediate Course for appearing in Intermediate Examination?

Ans: The Intermediate Examinations are held twice a year in the months of May and November

Candidate should be registered in Intermediate Course for a minimum period of eight months

on or before the 1st day of the month in which the examination is held. For example, a

candidate should be registered in Intermediate Course on or before 1st September, 2023 for

appearing in Intermediate May, 2024 Examination and on or before 1st March, 2024 for

appearing in Intermediate November, 2024 Examination.

What is the fee for Intermediate Course?

Ans: Fee for registration in both the groups of Intermediate Course is Rs.18,000/-.

When will the students registered through Direct Entry Route get Prospectus for CA Course?

Ans: After successful registration in the Intermediate Course through Direct Entry Route, the

student will receive an e-mail bearing the login credentials for ordering the Study Material

through Centralized Distribution System (CDS) Portal. Prospectus for CA Course will be

delivered to the student along with the Study Material, whenever ordered by the student.

I wish to appear in one of the groups of Intermediate Examination at a time. Can I register for one group of Intermediate Course?

Ans: You can appear in one of the groups of Intermediate Examination at a time but you need

to register for both the groups of Intermediate Course.

How to get the Study Material of Intermediate Course?

Ans: After successful registration in the Intermediate Course, the student will receive an e-mail

bearing the login credentials for ordering the Study Material through CDS Portal.

What is the examination pattern in Intermediate Examination?

Ans: There will be 30% case scenario/ case-study based MCQs and 70% descriptive questions in

all the six papers of Intermediate Examination.

Is there negative marking in MCQ based questions in Intermediate Examination?

Ans: There is no negative marking in MCQ based questions in Intermediate Examination.

What is the passing criteria in Intermediate Examination?

Ans: A student is declared to have passed in both the groups of Intermediate Examination

simultaneously, if he/she –

(a) secures at one sitting a minimum of 40% marks in each paper of each of the groups

and a minimum of 50% marks in the aggregate of all the papers of each of the groups, or

(b) secures at one sitting a minimum of 40% marks in each paper of both the groups

and a minimum of 50% marks in the aggregate of all the papers of both the groups

taken together.

Alternatively, a student is declared to have passed in a group, if he/she secures at one sitting

a minimum of 40% marks in each paper of the group and a minimum of 50% marks in the

aggregate of all the papers of that group.He/she can pass both the groups individually in

different sittings.

What is the criteria of securing exemption in paper(s) in Intermediate Examination and subsequently passing the Group?

Ans: If a student has appeared in all the papers in a Group and fails in one or more papers but

secures a minimum of 60% marks in any paper or papers of that Group, he/she shall be

exempted for that paper or papers in which he/she has secured 60% or more marks for the

immediately next three following examinations. The student will be required to obtain a

minimum of 40% marks in each of the remaining paper(s) and a minimum of 50% marks in

the aggregate of all the papers including the exempted paper(s) to pass the Group.

If the student is not able to pass the said Group in the following three attempts and has

exhausted the exemption granted to him/her, the student may opt for continuing of the said

exemption to the subsequent examinations provided that he/she shall be required to obtain a

minimum of 50% marks in each of the remaining paper or papers of that Group in order to

pass that Group.

What is the validity period of student's registration in the Intermediate Course?

Ans: The validity period for registration in the Intermediate Course is for 5 years from the date

of registration in the Intermediate Course which can be revalidated for 5 years with

revalidation fee of Rs.400/-. Revalidation is permitted only once for Intermediate Course.

5. CA Final Course

5.1 Introduction to the CA Final Course

The CA Final is the last and most demanding stage of the Chartered Accountancy (CA) course offered by the Institute of Chartered Accountants of India (ICAI). As the name suggests, this course represents the final leg of your journey to become a fully qualified CA, showcasing your expertise, competence, and commitment to excellence in the field of finance.

5.2 Eligibility criterial

Before enrolling in the CA Final course, you must fulfill the following eligibility requirements:

Completion of CA Intermediate: You should have cleared both groups of the CA Intermediate examination.

Articleship: Completion of the prescribed period of practical training, known as articleship, which typically lasts for three years.

5.2 Subjects and Syllabus

The CA Final course consists of eight subjects, divided into two groups:

Group I:

- Paper 1: Financial Reporting (100 marks)

- Paper 2: Advanced Financial Management (100 marks)

- Paper 3: Advanced Auditing and Professional Ethics (100 marks)

Group II:

- Paper 4: Direct Tax Laws and International Taxation (100 marks)

- Paper 5: Indirect Tax Laws (100 marks)

- Paper 6: Integrated Business Solutions (100 marks)

5.3 CA Final Exam Format and Scoring

The CA Final examination is conducted twice a year, in May and November. The papers are a mix of subjective and objective-type questions, testing your theoretical knowledge and practical application. To pass the exam, you need to secure a minimum of 40% in each paper and an aggregate of 50% across all papers in a single attempt.

5.4 Tips to Ace the CA Final Exam

Preparing for the CA Final exam is a formidable task that requires dedication, determination, and strategic planning. Here are some tips to help you conquer this milestone:

In-Depth Understanding: Develop a comprehensive understanding of the syllabus and exam pattern to create a structured study plan.

Official Study Material: Rely on the official study material provided by ICAI, and supplement it with reference books and practice manuals.

Revision and Mock Tests: Regularly revise concepts and practice solving past years’ question papers and mock tests.

Professional Coaching: Enroll in a reputable coaching institute to receive expert guidance and insights.

Time Management: Manage your time effectively to cover the entire syllabus thoroughly.

FAQ on CA Final

When can I register for the Final Course?

Ans: Student can register for the Final Course any time after passing both the groups of

Intermediate Examination. At the time of registration for Final Course, students would also

be registering for Self-Paced Online Modules.

What is the fee for Final Course?

Ans: Fee for registration in both the groups of Final Course is Rs.22,000/-.

: How to get the Study Material of Final Course?

Ans: After successful registration in the Final Course, the student will receive an e-mail bearing

the login credentials for ordering the Study Material through CDS Portal. The student may

order the Study Material of Final Course as well as that of Self-Paced Online Modules SET A

and SET B through CDS Portal.

When can I appear for the Final Examination?

Ans: You can appear for the Final Examination if you have fulfilled the below eligibility criteria:

• Registered for the Final Course,

• Have completed Practical Training six months before the first day of the month in which the

examination is to be held,

• Successfully completed Advanced Integrated Course on Information Technology and Soft

Skills (Advanced ICITSS), and

• Qualified all the 4 Self-paced Online Modules.

What is the examination pattern in Final Examination?

Ans: There will be 30% case scenario/ case-study based MCQs and 70% descriptive questions in

all the six papers of Final Examination.

What will be the manner of assessment in Final Examination?

Ans: Assessment for Paper-6: Integrated Business Solutions (Multidisciplinary Case Study with

Strategic Management) which is entirely case study based, would be open book examination.

Assessment for all the other five papers would be through closed book examination.

: Is there negative marking in MCQ based questions in Final Examination?

Ans: There is no negative marking in MCQ based questions in Final Examination.

What is the passing criteria in Final Examination?

Ans: A student is declared to have passed in both the groups of Final Examination

simultaneously, if he/she –

(a) secures at one sitting a minimum of 40% marks in each paper of each of the groups and

a minimum of 50% marks in the aggregate of all the papers of each of the groups, or

(b) secures at one sitting a minimum of 40% marks in each paper of both the groups and a

minimum of 50% marks in the aggregate of all the papers of both the groups taken together.

Alternatively, a student is declared to have passed in a group, if he/she secures at one sitting

a minimum of 40% marks in each paper of the group and a minimum of 50% marks in the

aggregate of all the papers of that group. He/she can pass both the groups individually in

different sittings.

What is the criteria of securing exemption in paper(s) in Final Examination and subsequently passing the Group?

Ans: If a student has appeared in all the papers in a Group and fails in one or more papers but

secures a minimum of 60% marks in any paper or papers of that Group, he/she shall be exempted

for that paper or papers in which he/she has secured 60% or more marks for the immediately

next three following examinations. The student will be required to obtain a minimum

of 40% marks in each of the remaining paper(s) and a minimum of 50% marks in the aggregate

of all the papers including the exempted paper(s) to pass the Group.

If the student was not able to pass the said Group in the following three attempts and has

exhausted the exemption granted to him/her, the student may opt for continuing of the said

exemption to the subsequent examinations provided that he/she shall be required to obtain

a minimum of 50% marks in each of the remaining paper or papers of that Group in order to

pass that Group.

What is the validity period of student's registration in the Final Course?

Ans: The validity period of registration in the Final Course is for 10 years from the date of

registration in the Final Course which can be revalidated every 10 years with revalidation

fee of Rs.500/-.

5.5 Enrolling for Membership with ICAI

To enroll for membership with the Institute of Chartered Accountants of India (ICAI), you need to follow the steps below:

Qualify the CA Final Examination: To become a member of ICAI, you must first qualify the CA Final Examination. The CA Final consists of two groups, and you need to pass both groups to be eligible.

Complete Articleship: After clearing the CA Final Examination, you must complete a minimum of three years of articleship training under a practicing Chartered Accountant. Articleship provides practical training and experience in various areas of accounting and finance.

Register as a member: Once you have successfully completed your articleship and cleared both groups of the CA Final Examination, you can apply for membership with ICAI.

Pay Membership Fees: Along with the application for membership, you will need to pay the prescribed membership fees as per ICAI rules.

Obtain Certificate of Practice (Optional): If you wish to practice as a Chartered Accountant, you need to obtain a Certificate of Practice (COP) from ICAI. This allows you to offer services as a Chartered Accountant in your own name.

Continuous Professional Development (CPD): As a member of ICAI, you will be required to comply with the Continuous Professional Development (CPD) requirements. This involves earning a specified number of structured and unstructured CPE (Continuing Professional Education) hours every year.

7. CA Course Study Resources

7.1 Recommended CA Course Books and Study Materials

“Accounting Standards (AS)” by the Institute of Chartered Accountants of India (ICAI): This book covers all the relevant accounting standards and is a must-read for CA students.

“Advanced Accountancy” by PC Tulsian: This book provides in-depth coverage of advanced accounting concepts and principles.

“Cost Accounting” by Paduka Publication: This book is useful for understanding cost accounting concepts and methods.

“Taxmann’s Direct Taxes Manual (DTM)” by V.K. Singhania: This comprehensive book covers direct tax laws and regulations in India.

“Taxmann’s Indirect Taxes: Law and Practice”: This book provides insights into indirect tax laws, including GST (Goods and Services Tax).

“Corporate Laws” by Munish Bhandari: A comprehensive book covering company law and related regulations.

“Mercantile Law” by M.C. Kuchhal: This book covers the legal aspects related to business and commerce.

“Auditing and Assurance” by Surbhi Bansal: A popular book for auditing concepts and practices.

“Information Systems Control and Audit” by A. Vallabhaneni: Useful for the CA Final students preparing for the Information Systems Control and Audit paper.

“Strategic Financial Management” by Ravi M. Kishore: A recommended book for CA Final students focusing on financial management.

9. After the CA Course

9.1 Opportunities and Career Pathways for CAs

As a Chartered Accountant (CA), you have a wide range of career opportunities and pathways to explore. Here is a list of some potential career paths and opportunities for CAs:

Public Practice: Many CAs work in public accounting firms, providing services such as auditing, tax consulting, and financial advisory to various clients.

Corporate Finance: CAs can work in the finance departments of corporations, handling financial planning, budgeting, financial analysis, and treasury functions.

Investment Banking: CAs with strong financial acumen can pursue roles in investment banking, working on mergers and acquisitions, capital raising, and corporate finance transactions.

Management Consulting: CAs can join consulting firms and offer financial expertise to help businesses improve efficiency, solve problems, and make strategic decisions.

Internal Auditing: CAs can work within organizations, conducting internal audits to ensure compliance, risk management, and operational efficiency.

Taxation: Specializing in taxation, CAs can work as tax consultants or advisors, helping individuals and businesses optimize their tax liabilities.

Forensic Accounting: CAs with an interest in investigations can pursue a career in forensic accounting, uncovering financial fraud and providing expert witness testimony in legal proceedings.

Financial Planning and Wealth Management: CAs can become financial planners or wealth managers, assisting individuals in managing their investments and achieving financial goals.

Government and Regulatory Bodies: CAs can work for government agencies or regulatory bodies, contributing to policy-making, financial regulation, and enforcement.

Non-Profit Sector: CAs can offer their financial expertise to non-profit organizations, ensuring proper financial management and accountability.

Education and Training: Experienced CAs can become educators, trainers, or lecturers, sharing their knowledge and expertise with aspiring accountants.

Entrepreneurship: CAs with an entrepreneurial spirit can start their own accounting or financial consulting firms.

Risk Management: CAs can work in risk management roles, helping organizations identify and mitigate financial risks.

Corporate Governance: CAs can serve on boards of directors, providing financial oversight and ensuring proper corporate governance.

International Opportunities: CAs often have the option to work internationally, as accounting and financial skills are in demand across the globe.

Technology and Data Analytics: With the growing importance of data analytics and technology in finance, CAs can leverage their skills in these areas.

Merger and Acquisition (M&A) Advisory: CAs can specialize in M&A advisory, assisting companies with valuation, due diligence, and deal structuring.

Sustainability and ESG: CAs can contribute to the growing focus on environmental, social, and governance (ESG) considerations within the business world.

9.3 Starting a CA Practice

Obtain the necessary qualifications: To start a CA practice, you must be a qualified Chartered Accountant. Ensure that you have completed all the required education, examinations, and practical training to obtain your CA certification.

Gain practical experience: Before starting your practice, it’s essential to gain some practical experience by working in an accounting firm, a company, or under the guidance of an experienced CA. This will help you build your skills, confidence, and understanding of real-world accounting challenges.

Create a business plan: Like any other business, a CA practice needs a well-thought-out business plan. Define your practice’s vision, mission, target market, services you will offer, pricing strategies, marketing plans, and financial projections. A solid business plan will be your roadmap to success.

Register your practice: Decide on the legal structure of your CA practice (sole proprietorship, partnership, LLP, or company) and complete the necessary registration and licensing requirements with the appropriate authorities. This may involve registering with your local professional accounting body and obtaining any business licenses or permits required in your area.

Set up your office: Choose a suitable location for your practice, keeping in mind accessibility for clients and cost considerations. Furnish your office with the necessary equipment and software required for accounting and taxation work.

Develop a client base: Building a client base is crucial for the success of your practice. Use your network, professional connections, and referrals to attract your initial clients. Provide high-quality service to create a positive reputation, leading to more word-of-mouth referrals.

Offer a range of services: As a CA, you can offer various services like accounting, auditing, taxation, financial planning, advisory, and more. Diversifying your service offerings can attract a broader client base and provide additional revenue streams.

Market your practice: Develop a marketing strategy to promote your CA practice. Create a professional website, utilize social media, and attend networking events to increase your visibility within your target market. Consider offering free workshops or seminars to showcase your expertise.

Stay updated: The field of accounting and finance is constantly evolving. Stay updated with the latest regulations, tax laws, accounting standards, and industry trends. Continuous professional development is crucial for your credibility and competency.

Focus on client satisfaction: Client satisfaction is key to the success and growth of your CA practice. Provide personalized attention, prompt responses, and valuable insights to your clients to build long-term relationships.

9.4 Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an essential aspect of professional growth and competency maintenance for various fields, including accountancy. In the context of California (CA), CPD refers to the ongoing education and learning activities that Certified Public Accountants (CPAs) and other professionals undertake to stay updated with the latest industry developments and improve their skills and knowledge.

9.5 Networking and Building Professional Relationships

Building professional relationships and networking are crucial aspects of career advancement and personal growth. Cultivating strong connections with colleagues, industry peers, mentors, and potential employers can open up various opportunities, such as career advancements, new job prospects, access to valuable resources, and industry insights.

10. CA Prospectus

11. Articleship

CA Articleship” refers to the practical training period that aspiring Chartered Accountants (CAs) undergo as part of their Chartered Accountancy course. The Articleship is a crucial component of the CA curriculum, providing candidates with real-world exposure and practical experience in the field of accountancy, auditing, taxation, and other related areas.

Here are some key points about CA Articleship:

Duration: The Articleship typically lasts for three years. During this period, CA students work under the guidance of a practicing Chartered Accountant or in a firm of Chartered Accountants.

Training Structure: The Articleship period is divided into two parts: a. First Year: A mandatory period of 12 months of service. b. Remaining Two Years: The candidate can choose to work either with a practicing CA or in a company’s finance/accounting department.

Role and Responsibilities: As an articled assistant, the CA student will be involved in various tasks such as auditing, accounting, taxation, financial reporting, and compliance-related work.

Stipend: During the Articleship period, students are generally paid a stipend. The stipend amount may vary based on the size of the firm, location, and other factors.

Examination Eligibility: Completion of the first year of Articleship is a prerequisite for appearing in the CA Intermediate examination.

Work Experience Requirement: To become a full-fledged CA, candidates must complete at least 2.5 years of Articleship (30 months) before appearing for the CA Final examination.

Registration: Aspiring CAs need to register themselves for Articleship through the Institute of Chartered Accountants of India (ICAI), which is the regulatory body for Chartered Accountants in India.

FAQ on Practical Traning/ CA Articleship

When can I commence Practical Training?

Ans: After passing both the groups of Intermediate Examination and successfully completing

Four Weeks Integrated Course on Information Technology and Soft Skills (ICITSS), you can

commence Practical Training.

What is the duration of Practical Training?

Ans: The duration of Practical Training is 2 years

What is the duration of Industrial Training?

Ans: Industrial Training is for a period of 9 months to 12 months, permitted during the last

part of 2 years Practical Training.

How many leaves will be permitted during Practical Training of 2 years?

Ans: The articled assistant would be permitted to take 12 leaves in each year of Practical

Training.

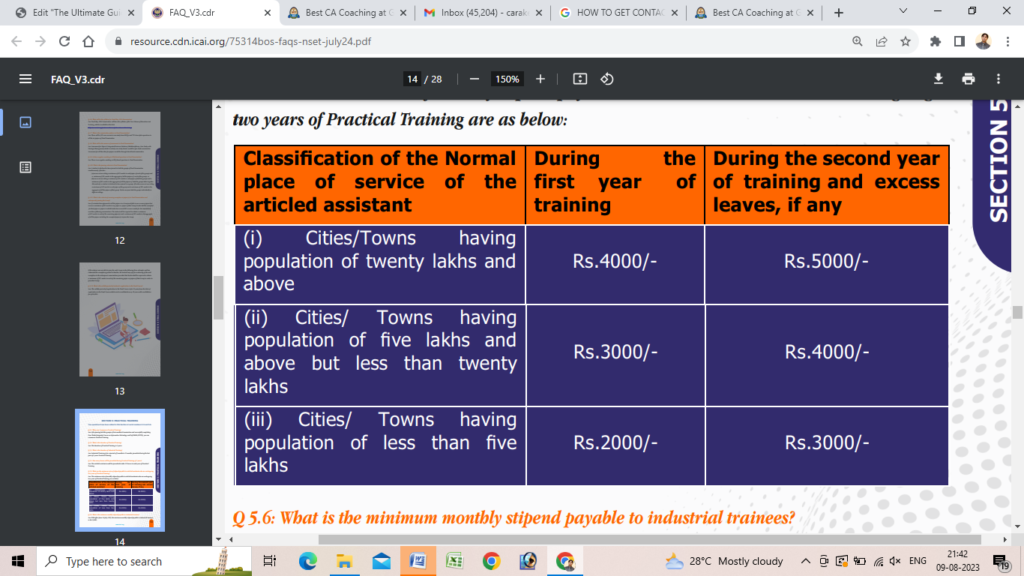

What are the minimum rates of stipend payable to articled assistants who are undergoing two years of Practical Training?

What is the minimum monthly stipend payable to industrial trainees?

Ans: With effect from 1st July, 2023, the minimum monthly stipend payable to industrial trainees

is Rs.15,000/-

What is Integrated Course on Information Technology and Soft Skills (ICITSS) and Advanced Integrated Course on Information Technology and Soft Skills (AICITSS)?

Ans: Integrated Course on Information Technology (ICITSS) is a combination of Orientation

Course (OC) and Information Technology Training (ITT). Advanced Integrated Course on

Information Technology (AICITSS) is a combination of Management and Communication

Skills (MCS) Course and Advanced Information Technology Training (Advanced ITT). ICITSS and

Advanced ICITSS are of 4 weeks each.

When is ICITSS to be undergone by a student?

Ans: ICITSS is to be completed before commencement of Practical Training

When is Advanced ICITSS (AICITSS) to be undergone by a student?

Ans: A student is required to complete AICITSS after completion of Practical Training but before

appearing in Final Examination.

Top CA Firms in India

In 2023, India boasts a plethora of distinguished Chartered Accountant (CA) firms known for their exceptional client services. Here, we highlight a selection of the leading CA firms in the country:

1. Deloitte India: As a global professional services firm, Deloitte excels in audit, consulting, tax, and advisory services. With a robust presence in India, it stands among the premier CA firms nationwide. Visit Official Website https://www2.deloitte.com/in/en.html

2. Ernst & Young (EY) India: Renowned worldwide, EY provides top-tier assurance, tax, transaction, and advisory services. Its prominence in India is marked by its commitment to high-caliber service delivery. Visit Official Website https://www.ey.com/en_in

3. PricewaterhouseCoopers (PwC) India: A global leader, PwC specializes in audit, tax, and advisory services. Its substantial presence in India cements its position as one of the nation’s leading CA firms. visit Official Website https://www.pwc.in/

4. KPMG India: Distinguished globally, KPMG offers top-notch audit, tax, and advisory services. Its well-established presence in India is synonymous with excellence in client solutions. Visit Official website https://kpmg.com/in/en/home.html

5. BDO India: A significant global player, BDO excels in audit, tax, and advisory services. Its robust presence in India solidifies its standing as a top-tier CA firm. Visit Official Website https://www.bdo.in/en-gb/home

6. Grant Thornton India: A recognized global entity, Grant Thornton is renowned for its audit, tax, and advisory services. Its strong presence in India reflects its dedication to providing high-quality solutions. visit Official Website https://www.grantthornton.in/

7. RSM India: With a global reach, RSM specializes in audit, tax, and advisory services. Its prominent stature in India positions it as a prominent CA firm in the nation. visit Official website https://www.rsm.global/india/

These firms represent just a snapshot of the exceptional CA firms in India during 2023. The landscape is rich with numerous other top-quality CA firms, each dedicated to delivering outstanding services to their clients.

Conclusion

Embarking on the journey of the Chartered Accountancy (CA) course is an incredible decision that can open doors to a rewarding and fulfilling career in the field of finance and accounting. As a student, it is essential to understand that the CA course is not a walk in the park; it demands dedication, perseverance, and a strong work ethic. However, the benefits and opportunities it offers make it all worthwhile.

Throughout this comprehensive overview, we have delved into the various stages of the CA course, from the foundation level to the final examinations, and discussed the registration process, syllabus, and examination pattern. We have also explored the importance of practical training, the role of coaching institutes, and the significance of self-study.

One of the key takeaways from this guide is the significance of time management and consistent practice. The CA course requires extensive preparation, and staying disciplined in managing your study schedule is vital. Seek support from family, friends, and mentors to stay motivated during challenging times.

Remember that failure is a part of the learning process. Many CA students face setbacks along the way, but resilience and determination will lead you to success. Stay focused on your goals and learn from your mistakes to improve and grow.

Networking and building professional relationships are crucial elements of a successful CA career. Engage in internships and networking events to expand your knowledge, gain practical experience, and open doors to potential job opportunities.

Lastly, never forget to take care of yourself both physically and mentally. The CA journey can be demanding, and it’s crucial to maintain a healthy balance between studies, personal life, and self-care.

As you embark on this exhilarating journey, always remember the reasons that motivated you to pursue the CA course. Stay committed to your dreams and goals, and success will undoubtedly be within your grasp.

Wishing you the best of luck in your pursuit of becoming a Chartered Accountant – a professional respected for their expertise, integrity, and dedication in the world of finance and accounting! May your journey be fruitful and transformative, leading you to a bright and prosperous future.